What are the parts of Medicare? And what do they cover?

Learn what Medicare health insurance is, how it works, and the hospital and care services that are typically covered under the 4 parts of Medicare: A, B, C and D.

When I first started my career in the Medicare world, I realized there was a lot of new information I had to learn and found that breaking it down into bite-sized chunks made it much easier to understand. I started by focusing on all the different parts of Medicare.

Here is a breakdown of what I learned to help you understand how Medicare works.

What is Medicare?

Simply put, Medicare is a federal health insurance program for:

- People 65 and older

- People under 65 with certain disabilities

- People with end-stage renal disease

The Medicare program offers basic coverage to help pay for things like doctor visits, hospital stays and surgeries.

When you’re eligible, you can enroll in Medicare Parts A and B – also known as Original Medicare – through the Social Security Administration. If you are already receiving Social Security or Railroad Retirement Board benefits you’ll automatically be enrolled.

Original Medicare covers the essentials, but there are a lot of services that aren’t included – important things like prescription drug coverage, annual hearing and eye exams, care needed when traveling outside the United States and much more. Services like these can be covered through private Medicare health plans and Medicare Part D prescription drug plans.

There are a few different times you can enroll in Medicare and a Medicare plan throughout the year. These are called enrollment periods.

Check out the graphic below to see when you can enroll, or read the article When and how to apply for Medicare for more in-depth info.

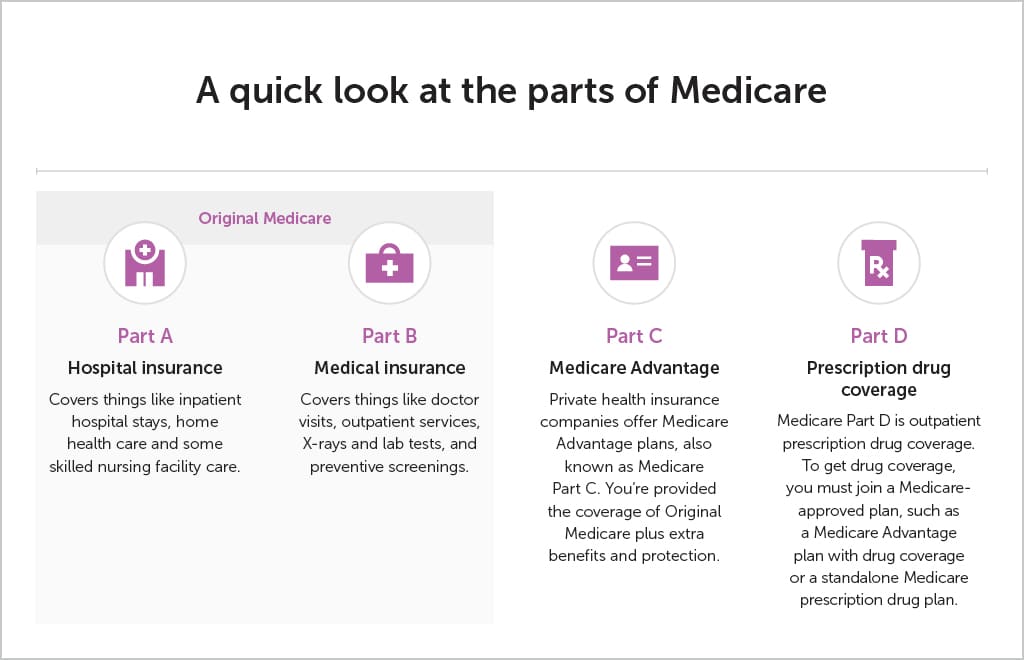

What are the 4 parts of Medicare?

Medicare is broken out into four parts.

- Medicare Part A – hospital coverage

- Medicare Part B – medical coverage

- Medicare Part C – Medicare Advantage

- Medicare Part D – prescription drug coverage

The parts of Medicare cover different services:

What does Medicare Part A cover?

Part A (hospital coverage) covers things like inpatient hospital stays, home health care and some skilled nursing facility care. Together, Medicare Parts A and B are called Original Medicare.

Is Medicare Part A free?

Typically, most people don’t pay for Part A if they have paid Medicare taxes for a certain amount of time while working. However, if you don’t qualify for premium-free Part A, it can be purchased for a monthly premium. This amount may vary each year and is based on how long you or your spouse worked and paid Medicare taxes.

What does Medicare Part B cover?

Part B (medical coverage) covers things like doctor visits, outpatient services, X-rays and lab tests, and preventive screenings.

Do you need Medicare Part B?

The short answer is yes, especially if you’ll need the covered services mentioned above. However, if you have health insurance through a current job or are on your spouse’s active plan, you can delay your Medicare Part B enrollment without penalty. Once the spouse with employer coverage stops working – whether it’s you or your partner – you have eight months to sign up for Part B. Also, you need to be enrolled in Medicare Part B if you want to sign up for a Medicare Advantage plan.

What does Medicare Part C cover?

Part C is also known as Medicare Advantage. Private health insurance companies offer these plans. When you join a Medicare Advantage plan, you still have Medicare. The difference is the plan covers and pays for your services instead of Original Medicare. These plans must provide the same coverage as Original Medicare (so you’re not missing out on anything). They can also offer extra benefits.

Why do I need to buy a private health plan?

Private Medicare health plans – like Medicare Advantage or Medicare Cost plans – cover everything Original Medicare does, and usually include more coverage for services you might need. Plus, they can include extra perks and benefits.

Find out more in the article, 4 reasons to buy a private health plan.

What does Medicare Part D cover?

Part D covers prescription drugs. Only private insurance plans offer it. It’s usually included in a Medicare Advantage plan or you can get a separate Part D plan.

Though Medicare Part B does cover certain vaccines and medications (based on specific health conditions), Part D provides a much wider range of coverage of vaccines and outpatient prescription drugs.

Read more about the differences in Part B and Part D coverage in the article, Does Medicare cover all of my vaccines?

Common services that Medicare does and doesn’t cover

Here’s general info about what Medicare does or doesn’t cover for common health care needs. Visit medicare.gov/coverage for more detail. Also, check a Medicare health plan’s Summary of Benefits to learn what’s covered.

- Once every 24 months if you have a high risk

- Once every 10 years if you aren’t at high risk

- Skilled nursing care or home health aide services that are part-time or occasional (intermittent)

- Physical, occupational or speech therapy

- Medical social services

What isn’t covered by Medicare?

Original Medicare covers the essentials, but there are a lot of services that aren’t covered such as:

- Deductibles, coinsurance and copays for covered services

- Most dental care

- Most outpatient prescription medicines

- Routine eye exams

- Routine hearing exams

- Hearing aids

- Fitness programs

- Services outside the U.S.

Services like these can be covered through a private Medicare plan.

What is the difference between Medicaid and Medicare?

Medicare and Medicaid are different programs. Medicaid is not part of Medicare.

Here’s how Medicaid works for people who are age 65 and older:

It’s a federal and state program that helps pay for health care for people with limited income and assets. A basic difference is that Medicaid covers some benefits or services that Medicare doesn’t like nursing home care or transportation to medical appointments (depending on your state and your eligibility).

Visit your state’s Medicaid/Medical Assistance website or medicare.gov for more information. Learn more in the article, Can I get help paying my Medicare costs?

Have more Medicare questions?

Our experts are here to help you find the best Medicare plan for the way you live. Learn all about your HealthPartners UnityPoint Health Medicare options.

Get Medicare Answers